By Roland Murphy for AZBEX

More than 150 attendees gathered in the auditorium of the Arizona Heritage Center in Tempe this week for the latest news on the shifting Arizona Construction market from two of the state’s leading experts on both the long-term history and day-to-day happenings in the sector.

The 2023 Midyear Update on Arizona Construction was a first-time program for BEX Companies, serving as a follow-up to January’s annual Construction Activity Forecast Event, which has quickly expanded to become one of the “must see” programs for industry insiders trying to keep their fingers on the pulse of the rapidly changing market. (AZBEX, Feb. 3)

Given the national tumult and plethora of headlines ranging from, “The Sky is Falling,” to, “What, Me Worry?” BEX decided to update the market halfway through the year using the same set of data sources. Since it is difficult-to-impossible to summarize a presentation developed through crunching six months of current data and years of historical information into a compelling narrative, we will leave you with only the highlights bolstered by a few images and relevant quotes.

The key takeaway from BEX Founder and President Rebekah Morris and DATABEX Manager Lya Parrish’s detailed presentations was this: Yes, the market is changing, but—at least for Arizona—that shift is a normalization rather than a doom and gloom collapse.

The Macro Details

As she does with most major BEX events, Morris kicked off her presentation with an update and review of the macro factors affecting the Arizona Construction market. Key findings from her review include:

- With a current total of 3.107 million jobs reported, nonfarm employment in the state is up 16.54% versus its 2007 pre-recession boom rate of 2.679 million.

- Construction employment still lags significantly behind its 2006 peak, however, currently reporting 186,700 jobs versus 240,300 previously. The state is still adding construction jobs, with 2022 seeing a 9% year-over-year growth.

- Construction activity has generally not been harmed by the lower employee numbers. Beginning in 2017, construction activity hovered at an annual change rate of around 10% year-over-year, with the notable exception of 2021. 2022 witnessed a booming resurgence of more than 20%, and 2023, though having calmed slightly, is projected to hit 16.63% growth.

Talking about how the market still saw slight growth even given the problems of 2021, Morris said, “We grew by about 1.9%, which is still really good considering all the issues that we had. The market actually was kind of scrappy. We still had to get stuff done. We had to work twice or three times as hard to deliver the same amount of production, the same amount of revenue.” She added, “In 2022… the chains came off. We grew by 24%, and then the data we have so far for 2023, we’re up 16.63%… The industry, the market for Arizona is still going very, very strong.”

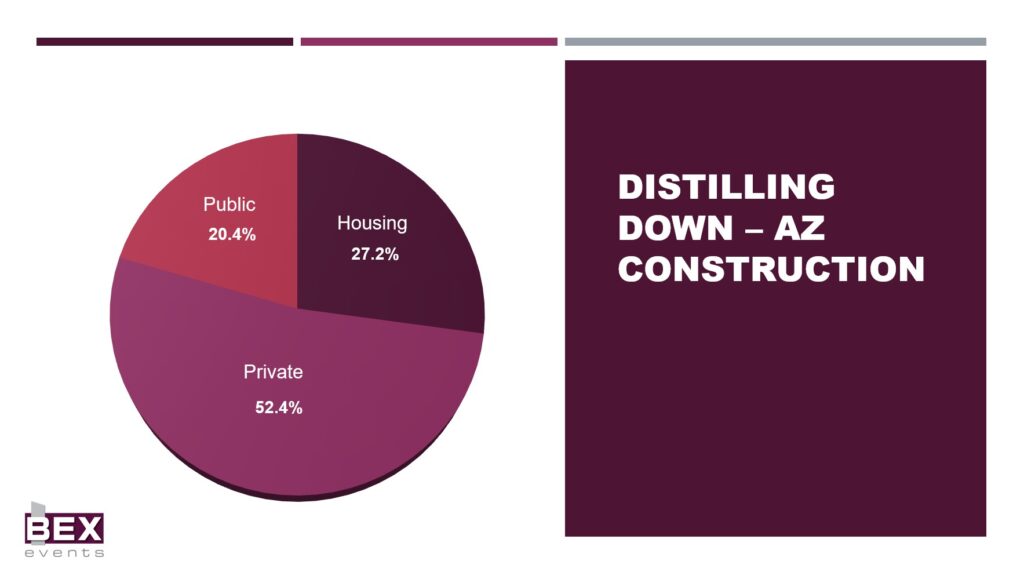

Morris explained that BEX follows three core areas (Public, Housing and Private) across nine primary sectors in construction to make up its market overview. While activity levels have seen a generally even one-third, one-third, one-third distribution between the three, recent years have shown a dramatic shift, with Private far outpacing the other two cores to arrive at current rates of Public at 20.4%, Housing at 27.2% and Private at 52.4%.

Public Sectors

Having gotten the audience up to speed on the overall state of the market, Morris jumped into updating activity and projections for the various components of the Public sector.

K-12

For 2022, K-12 accounted for 1.98% of the total market, reporting activity of $489.7M. Morris reported the number of active players in the owner, design firms and contractor segments have declined due to a lack of bond funding, a lack of interest and participation from the market and the impacts of cooperative contracting spreading opportunities for work among fewer firms.

The near future, however, could be very different for K-12 due to a resurgence in bond requests. There are currently 18 districts with bond requests planned for the upcoming elections, with a total request volume of $3.2B. More requests are expected before the deadline to file expires.

Even though bond requests have had difficulty securing voter approvals in recent years, and it is a certainty that not all this year’s requests will pass, the sheer volume of requests being made ensures enough will be approved to have a noticeable funding increase.

Largely based on that expectation, BEX has maintained its 2023 activity projection of $398M but increased its forecasts for 2024 and 2025 to $528M and $698M, respectively.

Public Spaces

Cities are flush with cash and eager to invest in public spaces, Morris said. Revenues from sales and property taxes are high, and municipalities are benefitting both from increasing tax bases from in-migration and ongoing monies from federal stimulus and infrastructure investment programs. Cities are also showing renewed interest in pursuing bond requests to fund new projects.

While there are multiple entry points for companies interested in opportunities in Public Spaces, one cautionary note is that organized resistance group activity has spread out of its traditional focus areas—usually concentrated on multifamily housing—and frequently begun questioning public projects, including new facilities and even parks and recreation projects that traditionally encountered little to no opposition.

In January, BEX projected the 2023 volume at $1B. Based largely on the increase in anticipated activity volume, the projections for 2024 and 2025 have been revised slightly upward.

Transportation and Parks

Transportation and Parks projects account for 9.99% of the market at $2.475B. In Transportation, Arizona saw 67 project starts and 41 completions in 2021, 110 starts and 99 completions in 2022 and 113 starts with 95 completions in 2023.

The elephant in the room for the sector is the current battle to put a renewal of the Proposition 400 Maricopa County half-cent transportation on the ballot for voter consideration. Former Gov. Doug Ducey vetoed widely supported enabling legislation for the request last year, and since then a block of Republican senators in the Arizona Legislature who oppose the current transportation plan’s emphasis on transit have stalled efforts to advance a new bill with similar program support.

If the tax is not passed, the impacts on transportation projects in Maricopa County and around the state will be significant, and projects currently in various stages of planning and development are already suffering setbacks.

Because the renewal question has not yet been resolved, projections have been revised downward. 2023 is now expected to see activity of $2.445B, with 2024 and 2025 now projected at $2.4B and $2.68B.

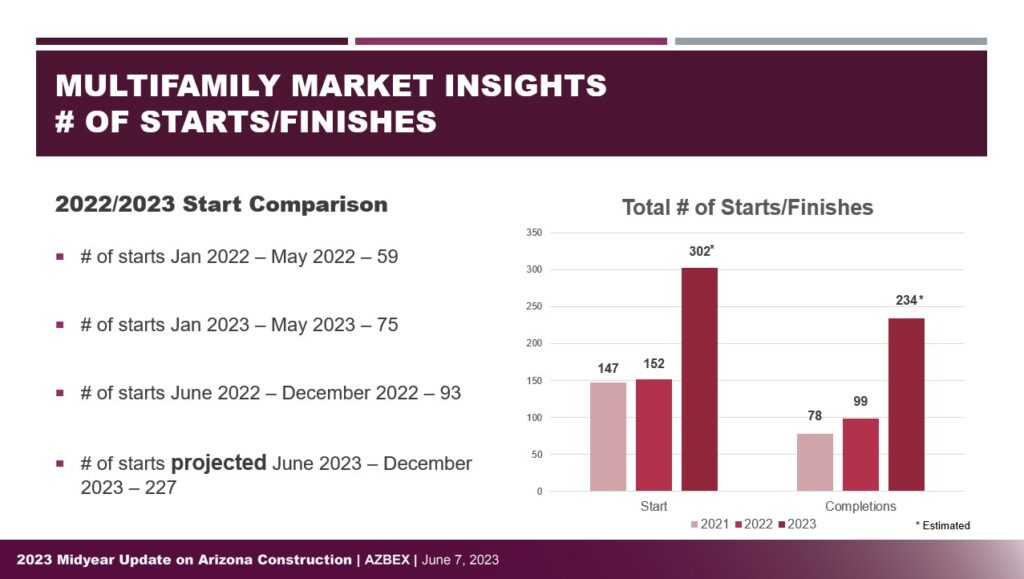

Housing

Following Morris, Parrish took the stage to update the audience on the state of Housing development in Arizona, particularly in the Multifamily sector. She explained Multifamily accounts for 22.24% of the market, totaling $5.51B.

The impending doom of Multifamily has been the topic of countless sensational headlines both nationally and regionally. “What we’re seeing is not what ‘they’ are seeing,” Parrish said.

While several factors have combined to slow the dizzying rate of growth Multifamily experienced during and after the pandemic (increased NIMBY activity, increased capitalization costs, new developers with unrealistic timeline and cost expectations, multiple re-pricings and changes in project team members, Build-to-Rent developers focusing on finishing existing projects before pursuing new opportunities, etc.), the market remains robust.

Parrish explained that the exceptionally high rates of rent growth and property valuation increase from the post-pandemic boom were unsustainable and that it was foolhardy to expect double-digit rates to continue indefinitely, adding what we’re seeing with the current slowdown is merely a normalization, rather than a collapse.

The volatility in the current market, she said, is due to funding and supply issues. Current project data show there were 41 projects on hold around the state in December. At the end of May, there were 67, but 36 of those projects were also on the December list. The encouraging news is there were 319 projects shown in the DATABEX project database as Under Construction in December, which has climbed to 328 as of May.

The market balancing will continue for the near future, as will the trend of developers taking their projects through the entitlement and permitting process and then selling them to other developers as the original projections become harder to pencil out.

Parrish reported the 2023 activity projection has been revised slightly downward from the January estimate of $6.9B down to $6.4B due to the normalization. She reminded the audience that volume is still $1B greater than 2022 activity. As the adjustments continue into 2024, the estimate has been revised to $6.2B from its original $7.2B. Parrish is expecting an increase in 2025 up to a total of $7B, rather than the initially projected $5.5B, but she said that will likely continue to roll over.

“The projects are there,” she said, “and new submissions aren’t slowing down… We haven’t slammed on the brakes; we’ve just eased back on the gas.”

Industrial

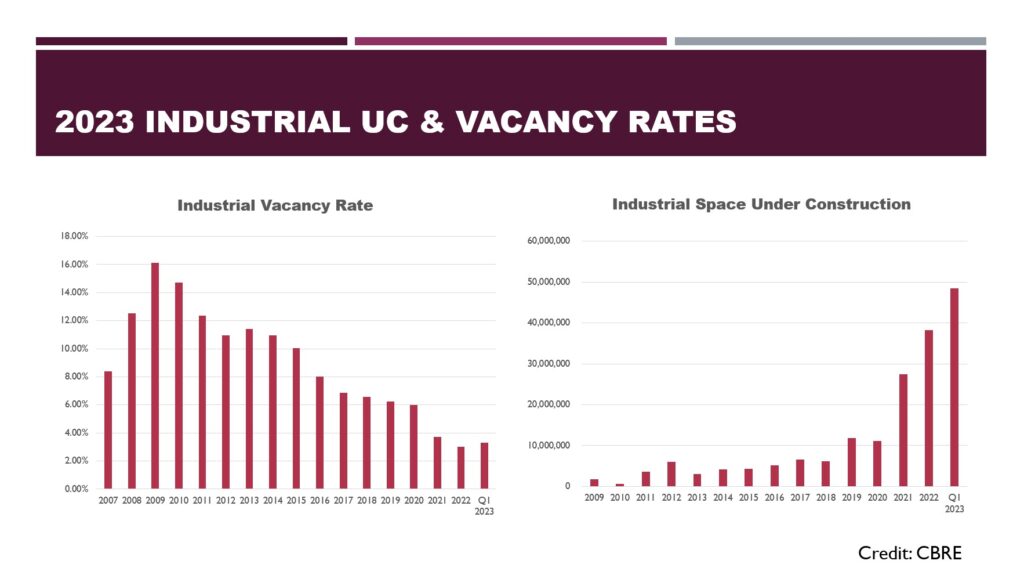

Industrial development has been the golden child of Arizona construction in recent years, swelling to a current sector valuation of $11.8B and making up 47.61% of the total market.

Parrish said the market has seen a slight softening in demand as delivery volume remains high. Vacancies hit 3.3% in Q1, up 0.3% from Q4 2022. Q1 saw deliveries of 5MSF, but square footage under construction reached a new high for the quarter as well, hitting 45.8MSF, a year-over-year increase of 72%.

Regarding the changes in projected activity since the January forecast, 2023 will remain a peak year for construction volume, but the estimated total has been revised downward by $1B to $13.9B. The 2024 prediction remains the same, also at $13.9B, and 2025 has been revised upward by $1B to $10.9B.

Key factors to keep in mind for the sector include increasing data center announcements, semiconductor manufacturing and supplier activity continuing to focus heavily on north Phoenix and Pinal County, and an ongoing move toward greater balance in the market, including a movement away from 1MSF “mega developments” to smaller projects in the 250KSF-500KSF range.

Conclusions

Taking the stage back from Parrish, Morris quickly summarized activity in some of the less prominent markets and then turned her focus on the big picture takeaways for the audience. The key points she gleaned from the compiled data were:

- If a national recession hits, Arizona will weather it better than most of the rest of the country;

- The Federal Reserve’s interest rate hikes appear to be working to slow the economy;

- The market has mostly accepted increased construction costs;

- Labor and supply chain problems are both easing and balancing each other out, and

- The industry has been too passive in the face of increasingly organized opposition to important projects. Construction needs more advocates who are more vocal and more willing to stand up for both the projects and the process.

STEVE BOSCHEN

STEVE BOSCHEN WENDY COHEN

WENDY COHEN ERIC FROBERG

ERIC FROBERG

REBEKAH MORRIS

REBEKAH MORRIS