By Roland Murphy for AZBEX

More than 200 stakeholders in Arizona’s public works and infrastructure community packed the conference center at the DoubleTree by Hilton Hotel Phoenix Tempe on Wednesday for the BEX Companies’ 2023 Public Works Conference.

Attendees were treated to project and process details from a who’s who of agency leaders and public officials who shared their visions and challenges across the half-day event.

Following brief introductory remarks by event emcee Amanda Elliot, redevelopment program manager for the Town of Gilbert, the presentations, panels and market news came at a steady clip for the rest of the day.

Top 10 Capital Improvement Programs Across Arizona

As is the standard format at a BEX event, President and Founder Rebekah Morris jumped immediately into a deep dive of industry performance numbers.

In the not-too-distant past, Morris said, construction spending in Arizona was largely evenly divided between Infrastructure, Commercial and Housing. In-migration, job growth and other drivers have shifted those levels and pushed Commercial up to 52.4% of market share, followed by Housing at 27.2% and Infrastructure at 20.4%.

Last year, the total construction volume in the state was approximately $22B; with 2023 numbers now projected to reach $25.7B. Expressed in terms of rate of change, 2022 activity was up 24.1% and 2023 year-to-date is 15.1%.

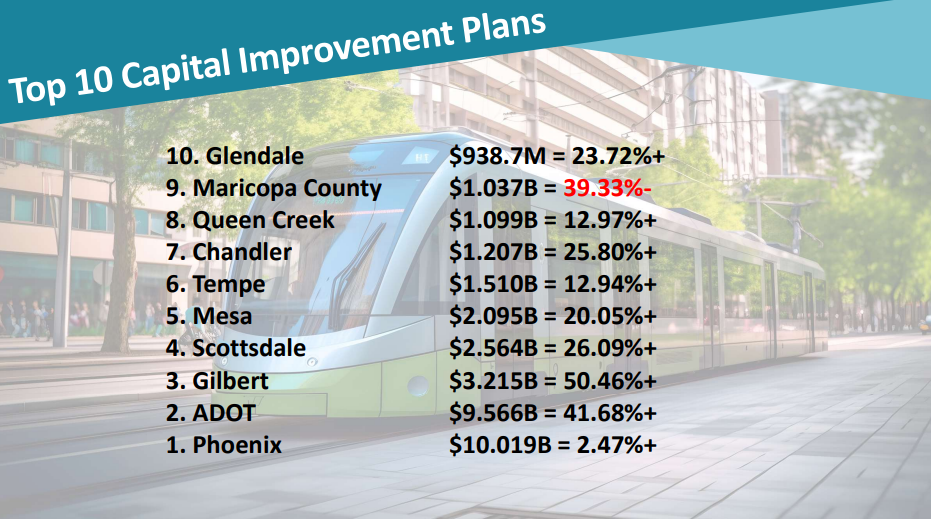

Next, she broke out the Top 10 Capital Improvement Plans by total amounts. Following a trend of the past few years, City of Phoenix narrowly once again took the lead position. At $10B, Phoenix narrowly edged out the Arizona Department of Transportation, which came in at $9.57B. The only member of the top ten with a five-year program of less than $1B was City of Glendale with $938.7M.

Nine of the top ten saw increases this year. Only Maricopa County’s showed a decrease. The County’s $1.037B was down 39.33%.

Legislative Issues Impacting the Arizona Construction Industry

The first panel discussion dealt with legislative issues affecting construction. The panel consisted of:

- Karl Obergh, Ardurra Regional Director (Moderator);

- Audra Koester Thomas, Maricopa Association of Governments chief of staff;

- Melonie Leslie, G&G Masonry president & founder, and

- David Martin, AGC President, Arizona Chapter.

Obergh started the session by asking panelists to detail the key legislative questions facing their operations. For Koester Thomas, it was the renewal of the Proposition 400 Maricopa County half-cent sales tax, which faced a tortuous process gaining approval for the 2024 ballot this year from the Arizona Legislature. Leslie discussed immigration and reform, particularly as it impacts the ongoing labor shortage in construction and elsewhere, and Martin talked about the impending sunset of state legislation allowing public entities’ use of Alternative Project Delivery Methods for horizontal discussion.

Discussing the impacts of the expiration of APDM, Martin told the audience that job order contracting, construction manager at risk and design-build project deliveries will expire in 2025 unless reauthorized by the legislature. “We’ll revert back to the low bid process for horizontal construction,” he said. “Our goal will be to get something done in the legislature to extend that for a time range further out than 2025.”

He asked audience members and public owners to lend their help to efforts to extend the authorization in the legislature and pointed out the sheer volume of work performed in Arizona under APDM contracts, implying strongly that a reversion to low-bid would be a dire circumstance.

Leslie framed immigration reform as not just a social issue but also a matter of vital importance in dealing with the ongoing shortage of construction labor. She said ongoing job training efforts, such as those included in The Carl D. Perkins Vocational and Technical Education Act, also known as The Perkins Act, were important but insufficient to meet actual needs. Leslie said legislation introduced in Congress earlier this year—commonly known as The Dignity Act—would greatly improve the available labor pool by, among other things, providing an expedited visa process for immigrants to come to the U.S. as well as providing a pathway to legal work for undocumented immigrants already in the country.

The Dignity Act is fledgling legislation with growing bipartisan support that is also intended to enhance border security and strengthen the E-Verify system.

“We’re listening to all these opportunities and we hear what’s new and what’s coming (in terms of construction projects). We have to remember we have to have people to do that. If we don’t have anybody here to do that, this is all just unfulfilled opportunities. We all need that infrastructure.”

When it came to her turn, Koester Thomas reminded attendees that Maricopa County’s growth over the last 40 years is largely the result of infrastructure investment, much of which was funded under the Proposition 400 sales tax. She then highlighted the immediate impacts on infrastructure development and investment if the tax is not renewed, including extensive project delays and cost increases.

MAG spent much of the last two years fighting in the legislature for approval of legislation to send the matter to voters. After former Gov. Doug Ducey vetoed a measure that had the unanimous support of all 32 MAG member agencies, a much more bitter and protracted fight emerged in the next legislative session. A compromise measure was eventually passed.

“We have a program with over $28B of transportation projects for the next 20 years… over half of that is dedicated from the half-cent sales tax,” she said. “It is the most instrumental funding source we have in the region to enable construction projects. It includes over 1,000 miles of new and improved arterial roadways across our region, investments in capital construction for the expansion of our transit system… and important modernization and construction projects.”

All three panelists expressed varying degrees of urgent need tempered with guarded optimism when asked about timelines and next steps for their key legislative issues.

Leslie said the Dignity Act is relatively a new legislation that has, so far, gained 20 co-sponsors and is under review in various committees. She acknowledged that the path to approval will not be immediate in the current political landscape. “With the election cycle coming next year, I don’t know that there will be a lot of activity on it other than comments and gaining co-sponsors, however, I would think that within a year… Something has to be done about the issues we’re facing, and I do expect to see a lot of traction on this within a year.”

Martin said an industry committee of contractors, owners and engineers has been assembled to bring the industry together around the issue of APDM authorization renewal. He estimated a legislative draft would be prepared in the next couple of weeks that would be shared with the community in hopes of building a coalition to move the legislation forward quickly.

Having finally secured legislative approval to send Prop 400 renewal to voters for consideration, Koester Thomas’s next activities are having the Maricopa County Board of Commissioners call for the election and then engaging in a public information campaign to build awareness and support in the voting community.

When asked what they need from the industry, Martin urged attendees to spread the word and to be vocal in their support for renewing APDM legislation. Leslie said there are no quick fixes and that reform will be a lengthy process. However, she urged attendees to contact their representatives and urge them to sign on as co-sponsors for The Dignity Act to increase its support and potential for passage in Congress.

Koester Thomas cautioned the audience not to take renewal for granted and urged attendees to engage with their personal communities and explain that the last 40 years of infrastructure development and growth are largely due to Prop 400-related investment.

Top Owner Panel #1: Tempe, Mesa & Queen Creek

The next two panels were discussions with representatives of some of the top owners from this year’s CIP review. The first was comprised of:

- Dean Howard, Alston Construction Director of Business Development (Moderator);

- Julian Dresang, City of Tempe city engineer;

- Beth Huning, City of Mesa city engineer, and

- Dave Lipinski, Town of Queen Creek CIP department director.

After introducing the panelists and letting them talk about operations and the state of projects and growth in their respective communities, Howard asked for an overview of the state of current projects in terms of on-time and on-budget performance.

Huning started the responses by saying Mesa projects are currently 69% on schedule and 79% on budget. The City’s goal is 80% for both criteria, but economic circumstances like cost inflation and materials availability have caused both schedule changes and revisions in scope.

Lipinski said nothing is currently completely on time or on budget for the same reasons, adding that the current economy and state of affairs make it impossible to project accurately and that there is only so much room to trim items in any particular project.

Dresang agreed, saying Tempe is struggling to deliver on budget, with many projects going beyond initial estimates by 30%-35%. He noted the City has had to put projects on hold or reduce scope.

When asked to explain the biggest challenge when it comes to delivering projects, Huning again said it is a combination of money and time. Long lead times for materials—more than 50 weeks in some cases—add multiple burdens to the process. She also highlighted complications arising from the sheer volume of consultants’ workloads and how those workloads result in occasionally poor quality in planning, which creates more change orders.

Asked what has changed in the last year, Huning said she has not seen much in the way of cost reductions, adding costs are generally 30% more than they were 18 months ago.

Dresang said bids are extremely inconsistent from contractor to contractor on any given item. He added that staff workloads are very heavy and that permitting takes far longer than it ideally would with full staffing.

Lipinski said the volume of work everyone is managing has made response times considerably longer but that some materials have become more readily available.

Noting the similarities in challenges facing the communities, Howard asked if the panelists had any creative ideas to improve on-time delivery.

Dresang said Tempe made heavy use of job order contracts and construction manager at risk APDM. The City sees less use of design-bid-build, except where required by federal programs. He said the City is trying to manage project workloads better and also focusing on deepening relationships and partnerships for greater collaboration and process enhancement.

Lipinski said Queen Creek focused on getting contractors and design staff involved as early as possible to predict complications and plan for solutions before problems actually arise.

Huning said Mesa had been forced to get creative in terms of value engineering and scope changes. Mesa has also undertaken efforts to keep work flowing to contractors consistently to ensure they remain on the City’s jobs and available as projects progress, rather than allowing time between projects that may lead to difficulties in scheduling when work is needed.

Howard then turned the question to the rate and quality of market participation in various project processes. Huning said contractors had shown little interest in design-bid-build projects, particularly those that are federally funded. Interest has, however, been heavy for CMAR and on-call projects.

Dresang said Tempe has also seen low contractor interest in design-bid-build but that CMAR projects get acceptable participation.

Howard segued those responses into asking if the past two-to-three years of volatility had changed panelists’ views on APDM. Dresang said Tempe is using it more as it gives the City more options. Lipinski called APDM essential.

Huning also expressed her appreciation saying APDM helps expedite projects and cut lead times, particularly on transportation projects.

The final question to the panel was to ask for advice for firms that want to work on the panelists’ projects. Huning urged contractors and designers to realistically access their workloads and to spend time getting to understand the projects before submitting proposals. She also urged them to be creative in their approaches, particularly in terms of anticipating and managing challenges.

Dresang advised them to make sure they perform currently contracted work well if they hope to secure new work in the future, and Lipinski urged them to believe in the selection and partnership process, saying, “Give us a reason to pick you.”

Top Owner Panel #2: Phoenix, Scottsdale & ADOT

The final panel of the day featured representatives from the two heaviest hitters in terms of CIP budgets and the City that has gotten the most public exposure for actual costs versus original estimates in one of the event’s liveliest sessions.

The panel was made up of:

- Kyle Ledbetter, Archer Western Construction, project executive (Moderator);

- Eric Froberg, City of Phoenix, city engineer;

- Alison Tymkiw, City of Scottsdale, city engineer, and

- Steve Boschen, Arizona Department of Transportation, infrastructure delivery & operations.

As they were introducing themselves and explaining the projects and circumstances affecting construction and planning at their respective agencies, Boschen brought up a slide that captured attention around the room.

Boschen used the slide in an attempt to explain the scale of construction cost inflation using ADOT’s “Construction Cost Index.” He reminded the audience that since 2016 the Consumer Price Index—the standard barometer for price inflation in the general economy—has gone up 49%. While inflation has sent shock waves rippling through the economy, ADOT has found that construction costs have inflated at a far greater rate and pace than consumer prices. ADOT’s Construction Cost Index shows an increase of 125%.

Between its established project needs, rising costs and instability in its funding mechanisms, among other issues, ADOT is also facing a massive funding gap over the next 25 years. Recent estimates put the deficit at $162B.

“That’s huge,” Boschen said. “A lot of people say, ‘Why isn’t ADOT doing anything about it?’ We work at the mercy of policymakers. We cannot advocate. We cannot market… So, this is where I’m asking you to be an advocate for transportation, for statewide transportation.”

The discussion then came around to Tymkiw. Many of Scottsdale’s current major projects are the result of a 2019 bond approval. Unfortunately, those projects were estimated in 2018, and costs have exploded in the intervening time. The disparity between the original amount and the actual costs has generated controversy within some portions of the community and City Council, and the matter has received extensive press coverage, particularly after the City had to add more than $50M from the general fund to cover overages.

Ledbetter then asked the panelists how public opinion impacts their short- and long-term project decisions. All agreed the impacts are significant.

Boschen reported more than 10,000 weighed in on ADOT’s recently released Long Range Transportation Plan and added the Department takes public involvement very seriously.

Froberg said public involvement in long-term planning is essential for determining priority and direction, then he evoked laughter from the audience with an example of short-term impacts. With the Arizona Diamondback’s recent victories leading to a berth in the World Series, immediately after the spot was secured this week, road closures and other planned work over the next couple of weeks were immediately put on hold to avoid inconveniencing residents and tourists during a major economic development moment.

Asked about the greatest obstacles to delivering projects on time and on budget, Tymkiw listed inflation, the ongoing labor shortage and materials availability. Boschen echoed problems with long lead times, saying it is often necessary to procure items before projects even go to bid. He said the situation is generally getting better, but the ongoing problem has made the process significantly more complex.

Froberg agreed with these difficulties and added that the quality of contractor work tends to go down when times are exceptionally busy. “Fast and wrong is still wrong,” he said. “I’d rather see you do it slower but right.”

When the question was posed asking panelists how they are planning for and responding to market conditions, Boschen said creativity in identifying and addressing problems as early as possible was essential.

Froberg said he has also started pushing back earlier in the process and prompting departments to be specific about precision and including what they need when they initially propose projects. He stressed the importance of planning ahead internally as well as with outside partners.

Tymkiw added APDM has been particularly valuable for her community and has helped to foster responsiveness, creative engineering and collaboration among the various parties.

All agreed there is a greater need to manage expectations. Froberg said it is essential to communicate with the public, internal staff and officials throughout the entire project process and to be clear about what is and is not possible.

Tymkiw said part of managing expectations is to get better with estimates and to get as much input and as many details as early in the process as possible so the project better matches what is ultimately submitted.

Boschen told the audience a key skill is learning to manage issues and triage “fires” for importance and impact as they arise. Another key item he has found useful is improved communications, including better project dashboards that show the public, partners and officials exactly where a project stands and what remains to be done until completion.

AZBEX NOTE: The BEX FY 2023-2024 CIP Special Report

As is part of the Public Works Conference every year, the event coincided with the release of the BEX FY 2023-2024 CIP Special Report. The report features detailed descriptions and line-item breakdowns of major projects from agencies around the state.

Every March, BEX Research staff begins tracking preliminary CIPs from more than 25 agencies around Arizona and spends the next six months assembling project information, cost and timeline details, and contact lists for agencies and major projects.

This year’s CIP is available through the BEX website here.

STEVE BOSCHEN

STEVE BOSCHEN WENDY COHEN

WENDY COHEN ERIC FROBERG

ERIC FROBERG