The Arizona construction industry remains strong in the face of uncertainty and slowing growth across the state as the demand for different developments and project types continues to shift.

On July 15, BEX held its 2025 Midyear Update at the Arizona Heritage Center in Tempe. BEX Founder and President Rebekah Morris, Researcher Andrea Howard, Researcher Aaliyah Koelzer and DATABEX Manager Lya Parrish each presented their respective findings on construction across nine separate market sectors.

Economic Factors

Morris began the presentation by discussing various data points that are essential to understanding markets across the state. The first, and one of the most impactful changes, is the slowing of population growth.

Prior to the Great Recession, Arizona experienced multiple years of more than 2% growth from 2001 to 2007. In fact, the stretch from 2004-2006 experienced annual growth of more than 3%. Population growth sharply fell in 2008 and then plummeted from 2009-2011.

Since then, population growth has experienced mild fluctuations across steady years of growth. Since 2022, however, growth has slowed considerably and is expected to continue to do so. “We were the top state for population growth and migration until recently. The most recent numbers I’ve seen from the AZ Commerce Authority put us at 12 or 13 right now,” Morris said.

Employment growth in Arizona has also begun to slow, and the state has even begun to shed jobs. The slowing, as of now, has not been detrimental and can be seen as fluctuations typical of a healthy economy. Furthermore, Arizona currently has 21.87% more jobs than its peak in 2007.

Construction employment specifically has yet to fully return to its early 2006 peak employment of 240.3K positions. Current data indicates there are 225.1K construction jobs in Arizona, which is a 6.33% reduction from 2006. Construction employment is still generally on the rise, however, as it is currently 4.16% greater year-to-date.

Revenue has continued to grow, with statewide construction revenue for 2024 being reported as $25.8B. Construction activity, however, has remained mostly flat, albeit with a slight dip. YTD, construction activity has slowed by 1.1%.

As many key indicators have begun to slow, Morris said the state is “easing its pace.”

Morris then pointed to a chart that distilled the different submarkets in the construction industry. Arizona construction is mostly private, with non-housing Private developments making up 52% of all projects. Housing follows with 26% of projects, which is followed by Public with the remaining 22%.

To cap off the market overview section of the presentation, Morris discussed the most prevalent challenges facing the industry. One of the most glaring difficulties has been “macro-uncertainty” caused by a variety of factors, such as volatile tariffs and other national economic policy considerations.

Another pressing issue is the availability of power supply vs. the drastically increasing demand, which has steadily grown as a priority, particularly with the growth of data centers as a statewide market.

Other important issues include organized resistance, slow agency reviews and permitting, and long lead times.

While the industry is facing newer challenges, some previous difficulties have been alleviated. Morris used the example of the labor pool of highly skilled workers. Arizona has seen an apparent increase in the availability of skilled labor where it once struggled.

Individual Market Sectors

Each sector was covered extensively by BEX staff in the presentation. Morris covered the entirety of the Public sector; Howard discussed the Housing sector; Koelzer presented the Industrial sector; and Parrish discussed her findings for the remainder of the private sector.

The slowing of the overall construction market, along with BEX’s generally optimistic disposition, was shown in a current data point across nearly all of the sectors. At the midyear point of 2025, nearly every sector and subsector are showing fewer project starts and fewer completions than we projected in the BEX 2025 Forecast Event earlier this year. (AZBEX; Feb. 7)

While the program provided more than enough detail to fill multiple regular issues, to maintain the value of attending the event in person, as well as wear and tear on readers’ eyes, we will simply summarize some of the key points across each sector.

Note: Top Projects marked with a * have changed since the 2025 Forecast Event.

K-12

Size: K-12 projects make up around 1.27% of the market with a 2024 value of $363.3M;

Top Project*: Tolleson High School #8 ($180M);

Top Owner: Maricopa Unified School District (13.04%);

Top Design Firm: DLR Group (30.3%);

Top GC: CORE Construction (24.91%);

Revised 2025 Construction Volume Projection: $498.2M.

Higher Education

Size: Higher Education projects make up around 1.12% of the market with a 2024 value of $319.8M;

Top Project: UA Center for Advanced Molecular and Immunological Therapies (CAMI) ($290M) (NOTE: In a highly unusual set of events, construction has paused indefinitely.);

Top Owner: Arizona State University (53.6%);

Top Design Firm: SmithGroup (27.97%);

Top GC: McCarthy Building Company (25.45%);

Revised 2025 Construction Volume Projection: $306M.

Public Spaces

Size: Public Spaces projects make up around 3.49% of the market with a 2024 value of $995M;

Top Project: Phoenix Sky Harbor Terminal 3 North 2 Concourse ($309M);

Top Owner: City of Phoenix (20.34%);

Top Design Firm: DFDG (8.02%);

Top GC: CORE Construction (8.55%);

Revised 2025 Construction Volume Projection: $1B.

Transportation

Size: Transportation projects make up around 8.59% of the market with a 2024 value of $2.45B;

Top Project: I-10 Kino to Country Club (aka Tucson/Benson Highway) ($553.6M);

Top Owner: Arizona Department of Transportation (49.29%);

Top Design Firm: Jacobs (12.78%);

Top GC: Sundt Construction (10.05%);

Revised 2025 Construction Volume Projection: $3B.

Utilities

Size: Utilities projects make up approximately 7.17% of the market with a 2024 value of $2.05B;

Top Project: SunZia Southwest Transmission Project ($1.5B);

Top Owner: City of Phoenix (11.97%);

Top Design Firm: Quanta Services (9.76%);

Top GC: Quanta Services (9.76);

Revised 2025 Construction Volume Projection: $3.2B.

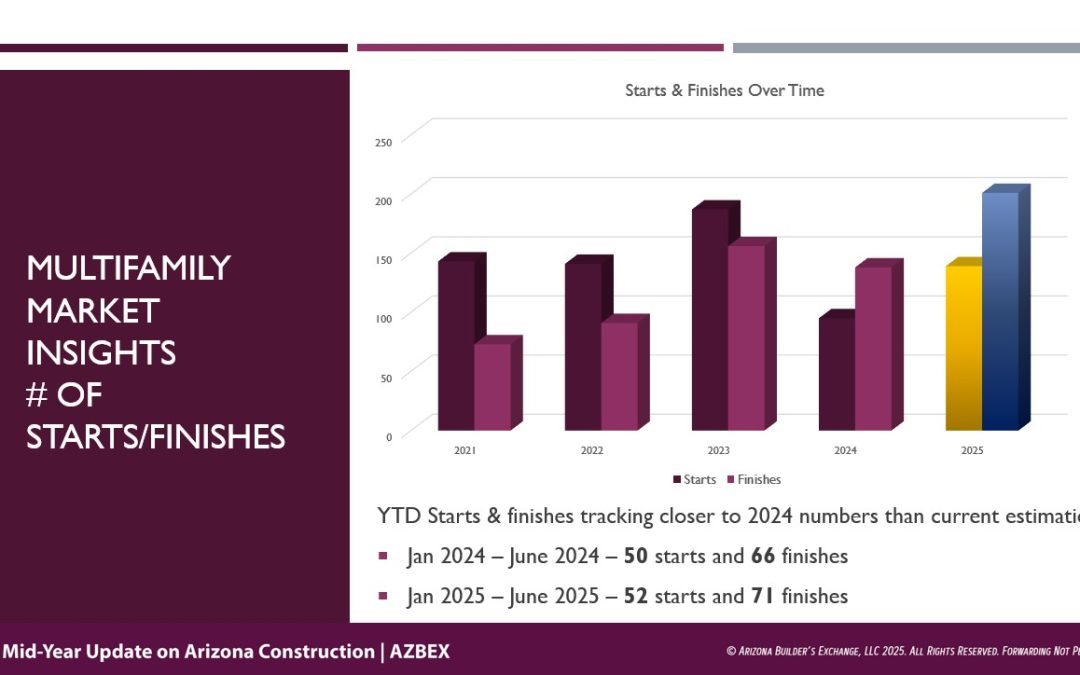

Multifamily (Apartments/Condos)

Top Project*: The Parque Phase I ($375M);

Top Owner: The Empire Group (29%);

Top Design Firm: Todd & Associates (8.6%);

Top GC: Clayco Inc. (3.1%).

Multifamily (Build-to-Rent)

Combined Multifamily Size: Multifamily projects (both apartments/condos and Build-to-Rent) combine for around 26% of the market with a 2024 value of $6.5B.

Top Project: Elanto at Queen Creek ($140M);

Top Owner: The Empire Group (12.1%);

Top Design Firm: Felten Group (25%);

Top GC: Hancock Builders (19.5%);

Revised 2025 Combined Multifamily Construction Volume Projection: $6.7B.

Industrial (Manufacturing/Warehouse/Self Storage)

Size: Industrial projects (including Data Centers, Warehouse/Manufacturing, Self-Storage and Landside Aviation) make up about 42.19% of the market with a 2024 value of $12B;

Top Project: TSMC ($19.5B) (Note: adjusted downward to account for equipment & machinery);

Top Owner: Taiwan Semiconductor Manufacturing Company (27.6%);

Top Design Firm: CTCI (27.62%);

Top GC: Okland Construction (24.37%);

Revised 2025 Combined Industrial Construction Volume Projection: $10.5B.

Industrial (Data Centers)

Top Project*: Hassayampa Ranch Data Center ($25B);

Top Owner: Stack Infrastructure (15.77%);

Top Design Firm: Corgan (33.267%);

Top GC: Holder Construction (22.3%).

Healthcare

Size: Healthcare projects make up about 2.17% of the market with a 2024 value of $620.6M;

Top Project*: Mayo Clinic Expansion – Phoenix ($1.9B);

Top Owner: Banner Health (22.57%);

Top Design Firm: SmithGroup (26.28%);

Top GC: Okland Construction (30.04%);

Revised 2025 Construction Volume Projection: $689.5M.

Hospitality

Size: Hospitality projects make up about 4.15% of the market with a 2024 value of $1.18B;

Top Project: VAI Resort ($1B);

Top Owner: Mosaic Quarter Development (9.55%);

Top Design Firm: JLG Architects (9.55%);

Top GC: Hensel Phelps (9.55%);

Revised 2025 Construction Volume Projection: $1.2B.

Office & Retail

Size: Office & Retail projects make up about 3.41% of the market with a 2024 value of $973M;

Top Project: Medina Station Commercial ($150M);

Top Owner: SimonCRE (9.91%);

Top Design Firm: RKAA Architects (10.71%);

Top GC: Whiting-Turner (7.7%);

Revised 2025 Construction Volume Projection: $973.6M.

What It All Means

The BEX 2025 Midyear Update ended with Morris returning to the stage with a brief recap. The dynamic of the Arizona economy is shifting and appears to be reaching a high-water mark in terms of population and employment growth. As always, this can continue to change as time goes on.

Higher Education, Industrial, Office/Retail and Healthcare are slowing. The University of Arizona is struggling and had to halt a large-scale project even though construction was already underway. Despite a handful of megaprojects in the Valley, the industrial market is starting to slow, as vacancy rates remain high due to new deliveries and a significant pipeline under construction. Regardless, it is poised to continue to be one of Arizona’s strongest sectors.

While Office has continued its post-pandemic slowdown, Retail has remained relatively healthy. Office is now seeing renovations on buildings to offer luxury amenities. Healthcare may be at risk due to the uncertainty surrounding federal funding.

K-12, Hospitality, Transportation and Utilities are still seeing steady growth. More, and often larger, ballot questions are being presented to voters regarding school developments.

Arizona continues to attract high-profile events, which has spurred the continuation of new Hospitality builds despite a lack of mega-projects in the sector.

With voters having approved the Proposition 479 half-cent transportation tax renewal in Maricopa County, many large-scale transportation projects are on the horizon. As time goes on, more information will be revealed.

Demand for Utilities has skyrocketed with the widespread introduction of data centers and the push for advanced water purification systems.

Public Spaces and Multifamily have become relatively stagnant as we enter the second half of the 2020s.

Taken altogether, the explosive growth seen in the Arizona construction sector, particularly post-COVID, is moderating. The previous pace and scale of that growth, however, means the market continues to generally maintain a robust volume across sectors.

STEVE BOSCHEN

STEVE BOSCHEN WENDY COHEN

WENDY COHEN ERIC FROBERG

ERIC FROBERG

REBEKAH MORRIS

REBEKAH MORRIS