By Roland Murphy for AZBEX

We come into every year planning the way forward with the best information we have available. We draw on past performance to indicate future behavior, check the current pace and direction, and then estimate what’s going to happen next.

As with every progression over time, it’s a good idea to check the path you’re actually traveling against the roadmap you set out at the beginning. This week, more than 200 people signed up to see and hear where the Arizona construction market is headed and compare that to the projections BEX research produced in our January Forecast Event. (AZBEX, Feb. 2)

As with the Forecast Event, BEX Founder and President Rebekah Morris and key members of the Research team provided updates on the three primary market sectors (Public Infrastructure, Housing and Private Development) across the 11 main markets (Education [K-12 & Higher Ed.], Public Spaces, Transportation & Parks, Utilities, Single-family, Multifamily, Build-to-Rent, Industrial, Healthcare, Hospitality, and Office & Retail).

The presentations were centered around data harvested from the thousands of individual projects the Research team inputs, updates and tracks in the DATABEX project database over the course of a year. By following and analyzing thousands of individual projects, BEX is in a unique position to identify and determine the state of the industry and its subsectors at any given moment and across set points in time.

The Midyear Update reviews the estimates and projections made at the beginning of the year and adjusts for the second half using current year-to-date information.

State of the Market

As is the standard formula, Morris kicked off the event by reviewing major economic factors that drive Arizona construction.

As it has for the past several years, Arizona’s population growth continues to hold at an annual rate of around 1.5%. Much of that in-migration is fueled by strong employment, with the latest data showing 3.26 million jobs in the state, a 21.69% increase from the state’s previous peak in 2007.

On the construction employment side, the state has continued to add jobs, generally. Not including the 2020 anomaly, year-over-year construction employment growth has been in the 5%-10% range.

Interestingly, Morris told the group, year-to-date construction employment has turned slightly negative, falling 0.69%. She cautioned attendees not to worry too much, as a percent change of less than 1% in either direction is, for all intents and purposes, flat. Still, Arizona construction employment remains 10.15% below the 2006 peak of 240,300 jobs.

Morris then turned to construction revenues, which continued to rise. During the 2006 boom revenue hit $21.67B. In 2023 revenues were $25.8B.

In terms of construction activity over time, and again discounting 2020, Arizona has generally seen rates of change of between 10% and 20% since 2017, with 2022 cresting above 20%. That pace slowed slightly in 2023, coming in at 17%, and year-to-date for 2024 is 7.25%.

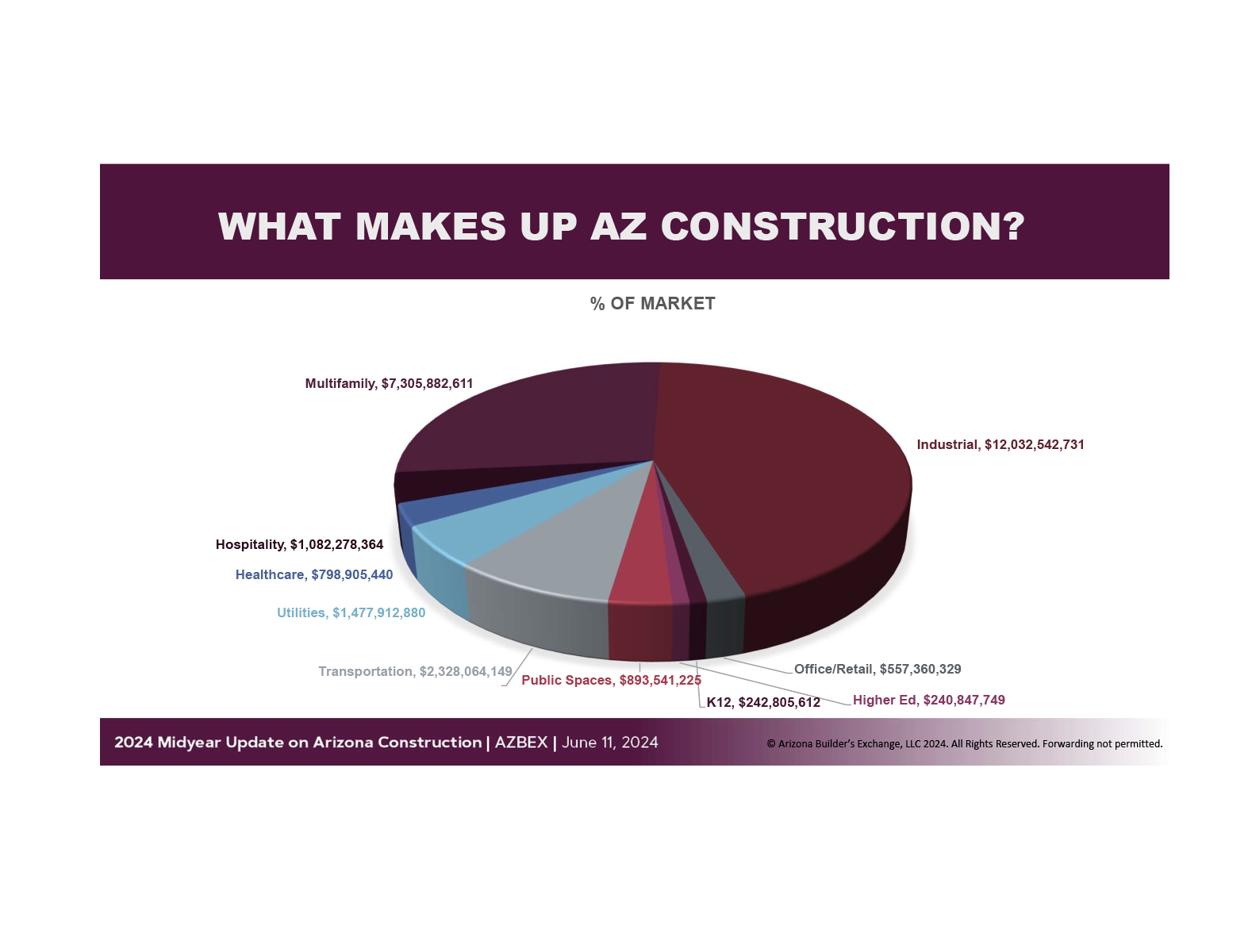

As has been the trend of the last few years, Industrial and Multifamily dwarf the other sectors in terms of market percentage. Simply put, Arizona is adding jobs and adding population, and people need places to work and places to live. The most current valuations put Industrial at slightly more than $12B, followed by Multifamily at $7.3B. The next closest sector is Transportation at $2.3B, followed by Utilities at $1.48B and Hospitality at $1.08B. The remaining five sectors are at less than $1B each.

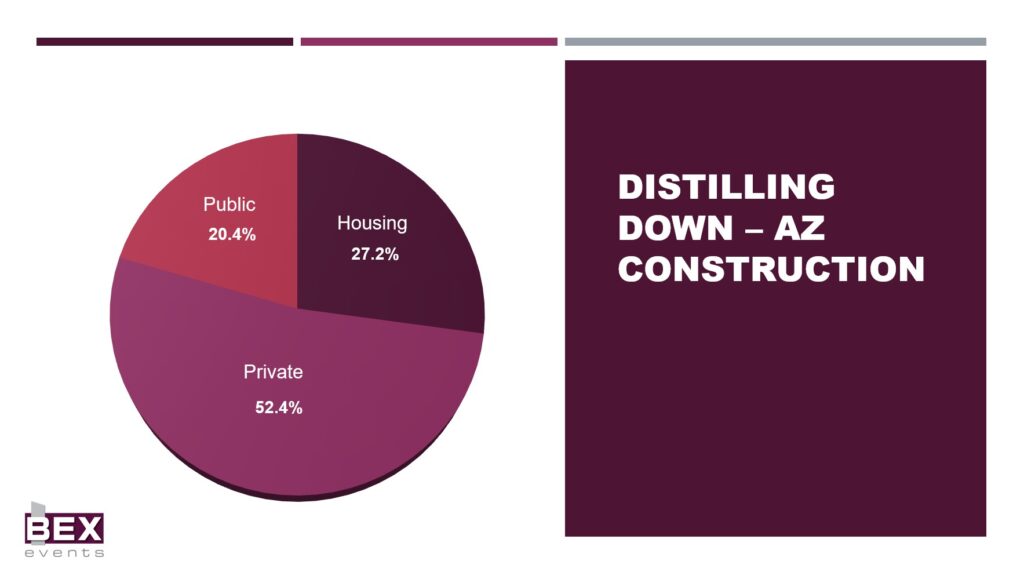

Segmented out, the three primary areas of Arizona construction come in at Private taking 54% of market share, Housing at 27% and Public at 19%.

Morris’ state of the market portion of the presentation concluded with the top challenges facing the industry:

- Funding,

- Demand exceeding available power supply,

- Neighborhood resistance,

- Slow municipal reviews and permitting, and

- Competition for highly skilled labor.

The availability of power for the various developments, ranging from feeding the ever-growing data center segment to keeping the lights on at both new and existing residences, is a comparatively new issue, and one to which Morris and the other presenters would frequently return. Demand has risen at a rapid rate, while delivery is plagued by the same issues as any other segment, resulting in significantly extended delivery times.

The Market Sectors

As was the case with the Forecast Event summary earlier this year, there was simply too much information to put together an expansive recap for each sector in this summary. In the interests of striking a balance between concision and thoroughness, we will stick to items to watch for the rest of 2024.

K-12 – 0.9% market share, $242.8M

Key points to watch out for include the recently started trial in a lawsuit filed by districts against the State alleging Arizona has failed to meet its obligations to adequately fund schools, particularly in terms of facilities construction. In addition, cooperative purchasing processes continue to throttle competition for services, particularly for design, in public school development.

Higher Education – 0.89% market share, $240.8M

Key points to watch out for include two major projects on the horizon for Arizona State University (ISTB 9 and the McCain National Library) and the fact that there is no infusion of funds expected in the near future for higher education development. Most work in the sector is small scale, and the universities rely heavily on job order contracting for fulfillment. Industry watchers should also be aware the ongoing budget challenges at University of Arizona are expected to continue to impact planning, design and construction of projects there for the immediate future.

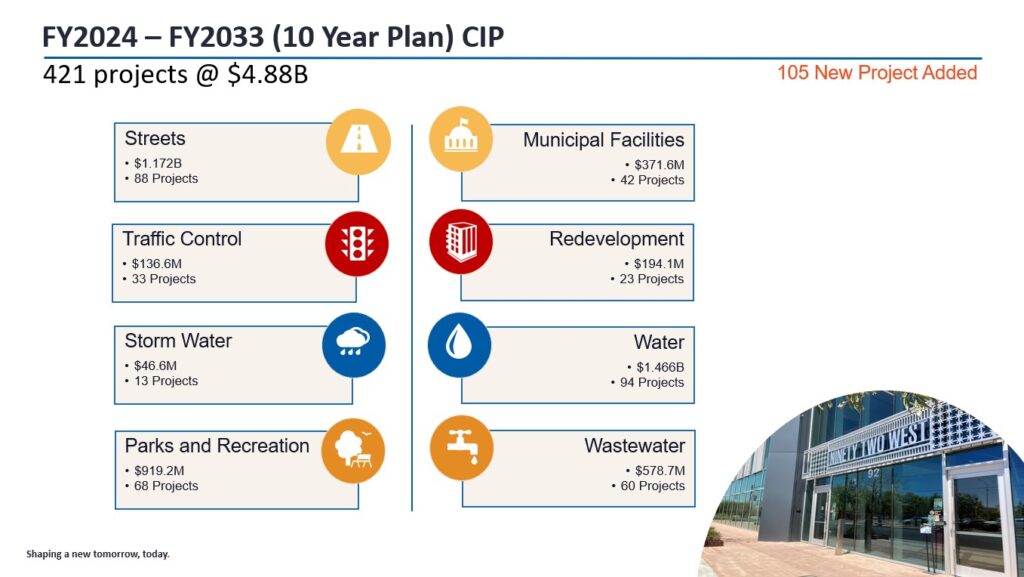

Public Spaces – 3.31% market share, $893.5M

In January, BEX predicted $1.1B in 2024 activity. That target will not be met, and local governments will shift toward renovations and upgrades rather than new construction. 2024 will likely be a peak year as budget constraints reemerge. Projects with dedicated revenue streams should still be secure, but development teams should expect to encounter more rounds of pricing revisions and proactive procurement for projects.

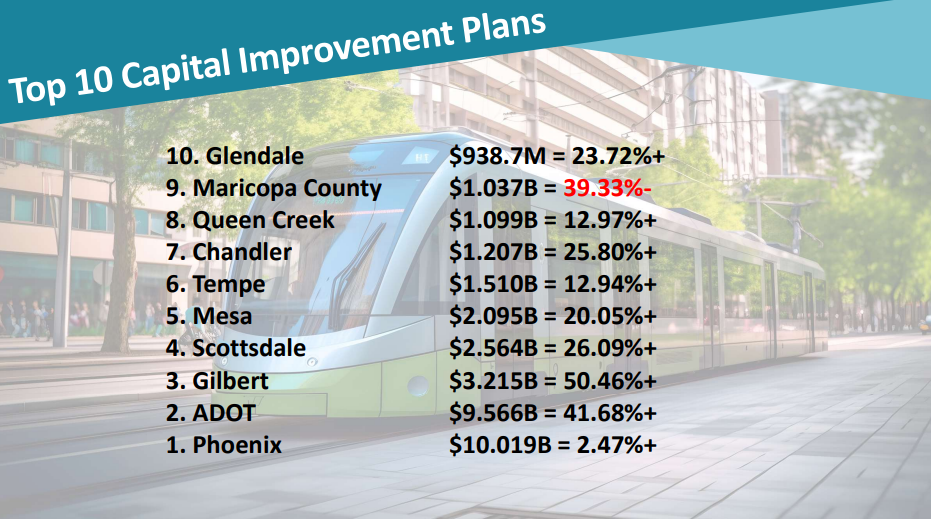

Transportation – 8.64% market share, $2.33B

The projected volume for 2024 has been revised slightly downward and is now estimated at $2.472B. Key issues to watch for over the coming year will be the fate of Proposition 479 half-cent transportation sales tax renewal in Maricopa County, the outcome of various municipal bond elections across the state, and future changes to alternative project delivery method regulations and legislation.

Utilities – 5.48% market share, $1.48B

2024 construction volume is estimated at $2.3B, and the market will likely remain above $2B for the next few years, based on available funding and future demand. Additional power generation and delivery capacities are becoming increasingly essential, and long-term water infrastructure investment is critical to continue fueling economic growth.

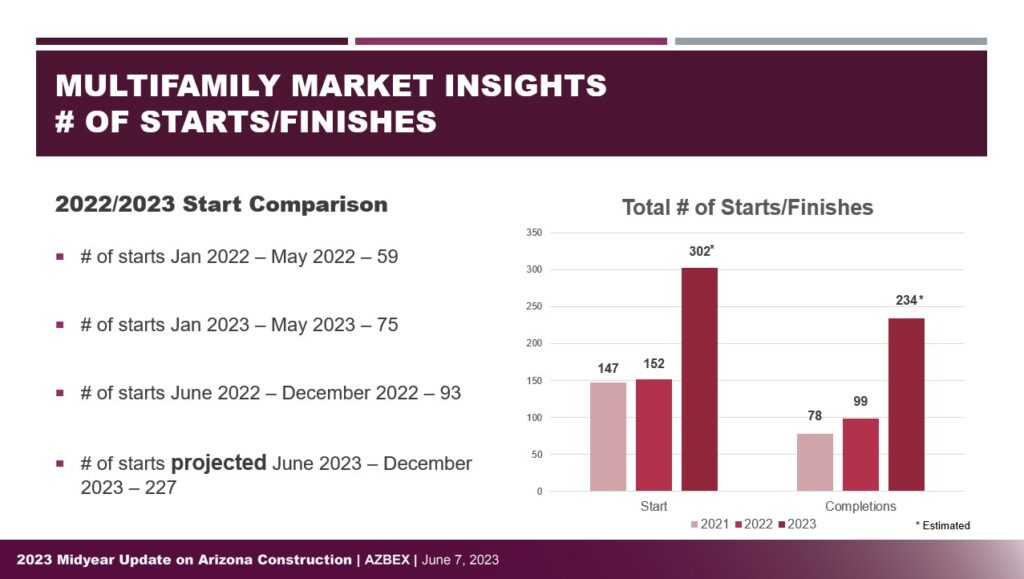

Multifamily – 27% market share, $7.3B

In January, multifamily construction across types was projected at $8.8B for 2024. That estimate has been revised downward to $5.33B. January through May saw only 31 project starts, which is fewer than half the number expected in January. While projects remain in queue, and new submissions are not slowing, project financing remains difficult, opposition is growing at the neighborhood and (in some cases) community levels, and the number of projects being put on hold or sold by one developer to another is increasing.

Over the course of the next 18 months, Multifamily observers should continue to expect delays and cancelations, added difficulties starting and finishing projects, and ongoing changes due to cost increases, materials and labor supplies, and growing resistance.

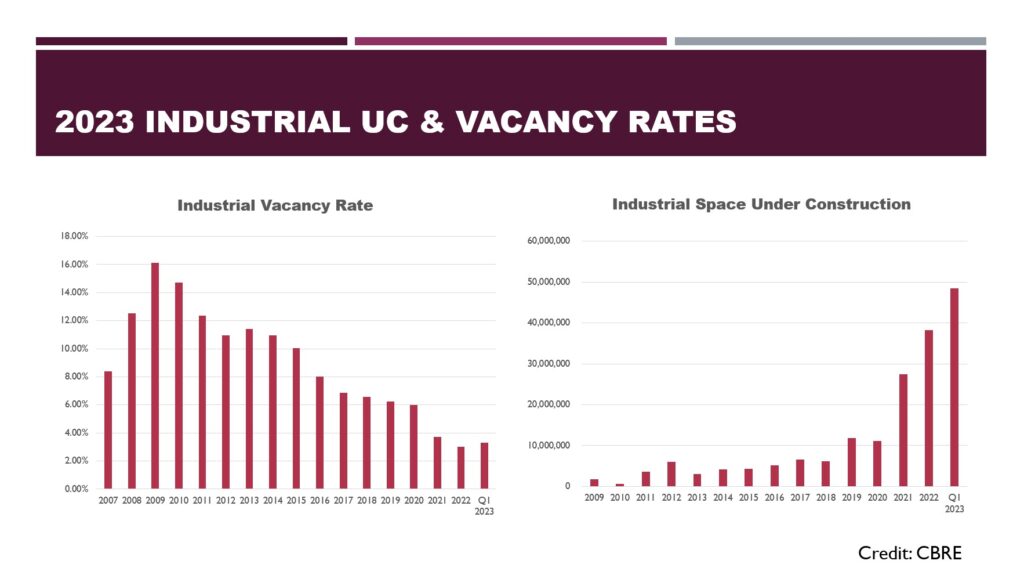

Industrial – 45% market share, $12.03B

Because of the massive uptick in Industrial projects and deliveries in recent years, production is currently slowing to meet demand. Vacancy is at 8.9%, which is up 1.5% from Q4 of 2023, and 30.7MSF is currently under construction. The most recent net absorption numbers were 4.5MSF. A total of 11.6MSF was delivered in Q1, compared to 3.1MSF in project starts.

Market watchers should continue to follow the ongoing surge in data center development, which is expected to occupy half the Industrial market by 2026. As noted above, utility capacity—particularly for power—will remain a challenge and could have an expanding impact on the pace of development and functional delivery.

Healthcare – 2.9% market share, $798M

Major healthcare firms continue to find building large, new hospital developments to be cost prohibitive. To that end, Banner Health scaled back its planned $400M Scottsdale Medical Center Phase I, centered around a major new hospital development, and instead produced a master plan that will start with a 119.5KSF medical office building to kick off development on the 52-acre site.

That reflects current trends in the sector. The big names still dominate, but new hospitals are prohibitively expensive at the moment and have also proven to be controversial with area residents when proposed. The master plans are scheduled for buildout across timelines of up to 20 years, and the most common development type at the moment is smaller MOBs.

Hospitality – 4.01% market share, $1.08B

In January, the estimated 2024 Hospitality construction volume was set at $1.24B. That number is unchanged moving into the second half of the year. There are several master-planned projects coming forward with hotel components included; occupancy is expected to remain at approximately 70%, and the volume of limited-service hotels in the four-story range remains strong.

Office & Retail – 2.06% market share, $557M

While Retail continues to significantly outpace Office, several major master plans have come forward recently that include Office components. Office developments are moving toward higher degrees of luxury and amenities, which may decrease the square footage while simultaneously increasing both costs and rents. As the population growth trend is expected to continue, Retail can expect to see the trend of major big box/major label developments continuing.

Conclusions

After the roundup of sector activity, Morris and the team offered up their conclusions based on the midyear data review:

- Industrial, Multifamily, Healthcare and Hospitality are slowing;

- Office & Retail, Education, Public Spaces, Transportation and Utilities (especially Utilities!) are growing;

- The economy is beginning to cool in line with the goals set by the Federal Reserve with its earlier interest rate hikes, and

- While construction employment growth has turned slightly negative, commercial real estate transactions are turning positive again.

Based on the revised activity shown year-to-date, the current construction market activity predictions have been set at $26.6B for 2024, $25.2B for 2025, and $26.7B for 2026.

Be sure to check and see how those projections turn out when the Forecast event rolls back around early next year.