Contractors, design firm representatives and other public infrastructure development watchers from around Arizona were treated to a smorgasbord of Capital Improvement Plan and other details October 18th at the BEX Companies’ 2022 Public Works Conference.

This year’s half-day event was held in the conference center at the DoubleTree by Hilton Hotel Phoenix Tempe. Following brief introductory remarks by event emcee Amanda Elliot, redevelopment program manager for the Town of Gilbert, the presentations, panels and information flowed at a fast and furious pace for the next four hours.

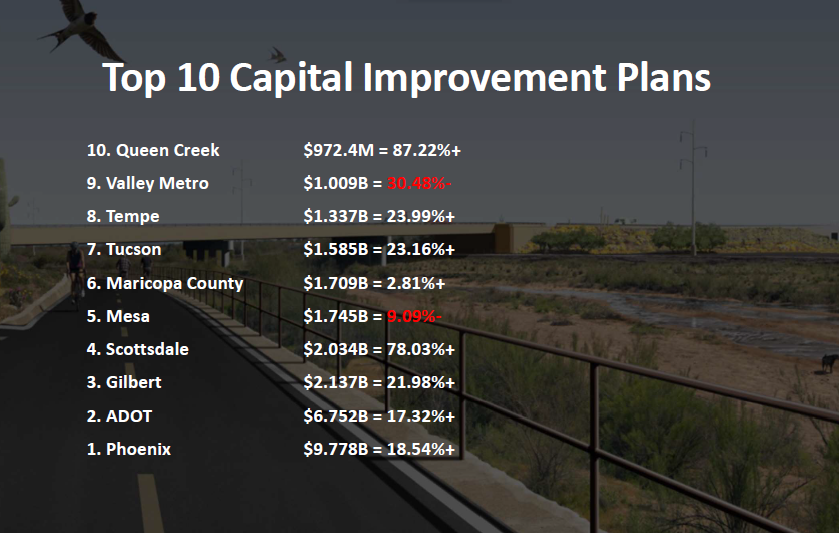

Top 10 Capital Improvement Programs Across Arizona

Kicking off the event, as she usually does, BEX Companies President and Founder Rebekah Morris let attendees know early on that even though overall construction activity in 2022 is on track to surpass 2021 volumes by more than 20%, Public Infrastructure has fallen to just 22% of the overall volume, compared to 45% for Commercial and 33% for housing.

Just a few years ago, she said, the pie chart was evenly split between the three sectors. Even though public infrastructure spending is a smaller percentage of the overall market, Morris reported CIP totals were up 15.22%. She also pointed out the broad spectrum of projects under consideration across agencies, from the perennial roadway and transit projects to expanding investments in parks and recreation and water infrastructure for many agencies.

Next, she broke out the Top 10 Capital Improvement Plans by total amounts. As has been the case for the past few years, City of Phoenix once again took the top spot, remaining ahead of former long-time front runner the Arizona Department of Transportation by nearly $3B for this planning cycle.

She also pointed out that nine of the Top 10 CIPs this cycle totaled more than $1B. The only exception – Town of Queen Creek – was a surprise newcomer to the list, knocking out City of Chandler by a mere $13.1M.

Also of note was the fact that eight of the 10 entries’ plans increased over the prior cycle. Maricopa County’s plan went up a modest 2.81%, while Queen Creek’s soared by a “whopping” 87.2%. Valley Metro’s plan fell by 30.48%, largely due to the number of projects on the agency’s books that are transitioning from development to maintenance statuses.

Wrapping up her segment, Morris reminded attendees about the more than 15% increase in CIP totals this cycle even though Public projects continue to be a smaller portion of the overall construction market. She then whetted their appetites by highlighting the fact that CIP projects are almost all front-loaded in terms of funding allocations. “The next two years should be very strong for publicly funded infrastructure and public projects in Arizona,” she said.

In her general outlook for the Public sector moving forward, she reminded both the public representatives and private industry staffers in the audience that construction price increases are not going away anytime soon.

She also said firms simply must be given more time to bid projects. She said contractors are declining to bid on projects because short submittal deadlines do not give them time to get quotes and information from subcontractors and materials suppliers they need to adequately prepare bids. Concurrent with the need for more time, she said, is the need for flexibility in the current volatile environment in terms of dealing with potential supply constraints and materials complications.

Expanding Transportation Systems

The afternoon’s first panel discussion dealt with the state of transportation systems expansion in Arizona and where the sector is headed in the near- and mid-terms. The panel consisted of:

- Albert Santana – Ardurra client services manager (Moderator),

- Jesse Gutierrez – Maricopa County Department of Transportation deputy director,

- Henry Ikwut-Ukwa – Capital Development-Capital Planning director for Valley Metro, and

- Kini Knudson – City of Phoenix Street Transportation Department director.

After giving the panelists an opportunity to briefly introduce themselves and their agencies and to explain their funding sources and major project focuses, Santana launched into the question-and-answer portion of the panel discussion. He first asked them to describe what challenges they are seeing in the state of the skilled labor market, both in their operations and in the market in general, particularly as it impacts deadlines and project deliveries.

Gutierrez said that from the internal side, MCDOT was experiencing problems recruiting enough skilled personnel to handle its workloads. On the external side, he said, the agency was experiencing difficulties in getting enough bids on projects. “We’ve seen jobs with only one bidder,” he said, “and several jobs with only two bidders, in fact. We’re seeing that more and more. It makes it very difficult, obviously.”

He added that when they do get teams on board, they show “tremendous effort” and dedication to getting the jobs done.

Ikwut-Ukwa agreed, saying the current tough state of the skilled labor market is a crisis across the entire economy and said he has seen some positions remain open for more than a year. He praised partnership efforts between contractors and others in the development community working with resources like community colleges and other education programs to develop trades training campaigns, saying they were needed contributions to the future of skilled labor development.

He cautioned, however, about the overall state of labor at the moment. “If this continues much longer,” he said, “it’s going to affect how long it takes to deliver projects.”

Knudson said it has become an ongoing challenge to manage expectations, particularly with a 24% job vacancy rate at City of Phoenix. He said he reminds his staff regularly that Street Transportation is known for its ability to deliver. “We can do a lot of things in the short term. We have a reputation for delivering projects and for getting things done, but you can’t live like that forever… It just isn’t healthy for our staff. It isn’t healthy for how we do things or how we want to do things.”

He added that the pressures are great but that he takes a degree of comfort in the fact the labor problem is not industry specific. With all industries experiencing variations of the same problem, there is more understanding than there would otherwise be.

Santana then asked the panelists for their thoughts on construction cost increases.

Knudson said he had to wonder if the current state of 20%-30% increases represented “a new baseline” in the project development world. He added the situation is a balancing act. “We have to plan, but we don’t want to overreact.”

Gutierrez said MCDOT is seeing increases in the area of 30% and is responding by phasing some previously planned projects that were to be built all at once into smaller segments, swapping out some materials for others when possible and trying to maintain flexible schedules for materials and project component deliveries.

Ikwut-Ukwa said Valley Metro was fortunate that its two major current projects were locked in with Construction Manager At Risk providers before the pandemic, although he acknowledged the pain the vendors are experiencing as a result and stressed his agency’s flexibility in working with them to mitigate the impacts where possible.

For new projects like the Light Rail Capitol Extension, he said he is seeing cost increases of 30% more than the original estimate in 2020. He appeared to speak largely for the entire room when he said, “Prices are out of whack.”

Powering Up Future Economic Development

The next panel, Powering Up Future Economic Development, dealt with the changing state of Arizona’s power supply needs and delivery systems as providers move to achieve aggressive sustainability and environmental goals without sacrificing reliability. The panel consisted of:

- Diane Fischer – Kiewit director of generation services (Moderator),

- Karla Moran – SRP principal economic development analyst and

- Kelly Patton – APS economic development manager.

Both panelists in their introductions talked about the exponentially increasing needs and demand for power mega-users in the current development cycle.

Moran pointed out SRP currently has 251 active Greater Phoenix Economic Council prospects, 13 semiconductor projects, 39 “mega projects,” and more than 9,100MW of potential new load on the SRP system. SRP’s historical growth area includes the Price Road Corridor and Mesa Tech Corridor, with major potential new growth areas around the Loop 202 South Mountain Freeway and the Superstition Vistas area southeast of Apache Junction.

Patton’s economic development impact summary included 219 active projects, 15 pending locates, 26 locates so far in 2022, and a phase one potential new load of 6,100MW. Major APS activity areas include Buckeye, the Loop 303 Freeway corridor, north Phoenix around the TSMC plant, and major swaths west of Casa Grande and east of Eloy.

When Fischer posed the question, “What’s the hardest part about sustainability?” both panelists were off and running. Patton explained education and understanding of process has to come before policy. She used the example of Arizona’s exceptional hunger for solar projects, given the state’s climate and volume of sunny days per year.

She pointed out that solar, by itself, is not a 24×7 solution and that issues like storage and transmission of generated energy are every bit as vital to the process as the solar energy capture, itself. She said people need to understand that, at the operational level, a 100% renewable energy supply is not possible.

Moran piggybacked on Patton’s statement and explained growing resistance to solar development in particular areas – like Coolidge’s recent moratorium on solar development in agriculture-designated areas – compounds the problem.

She said it is possible to build developments farther and farther away from population centers, but the farther out they are built, the greater the need for transmission infrastructure development. She also said building on vacant desert land, particularly federal land, requires addressing an ever-increasing load of permitting and environmental impact issues that lengthen production times and add still more costs and technology-related issues.

When asked how the energy provision landscape has changed in the last five-to-10 years, Patton said the level of activity has seen a massive increase, with utilities going from having a couple mega projects on their plate then to now having a few dozen.

Moran said the big challenge has been in educating clients about issues like cost shifts, project premiums and cost acceleration for high-priority projects. She stressed clients need to understand that every new component must be created and implemented, and that these needs require investments of both time and money.

Fischer closed the session by asking what advice the panelists would give to builders working in the power sector.

Moran said SRP is outsourcing a great deal of work, with workloads going up but resources not following suit. As a result, partnerships and expertise are vital.

Patton said 50% of APS’ distribution and transmission work relies on vendors. She urged everyone to understand that utilities are suffering supply chain impacts just like every other industry, and that partners can help to educate companies about timelines and managing expectations. “Help us help you,” she urged.

Show Me the Money!

The third panel, entitled “Show Me the Money!” focused on funding sources for transportation and infrastructure projects, including recent federal stimulus monies, regional transportation tax measures and bond propositions. The panel was made up of:

- Patti Olds – Kuniklo economic impact advisor (Moderator),

- Audra Koester Thomas – Maricopa Association of Governments transportation planning program manager,

- Kristine Ward – ADOT CFO, and

- Casey Ambrose – Town of Gilbert senior project manager.

After the panelists introduced themselves and their agencies, Olds started the questioning by asking them about their funding sources.

Ward immediately started off by passionately explaining the Infrastructure Investment and Jobs Act allocation for Arizona was not the $5.3B lump gift many people and reports seemed to believe. She explained allocations are set for $1.3B over five years and pointed out there are numerous different programs and requirements attached to funds.

She specifically differentiated monies that are awarded through program grants and those awarded through competitive discretionary grants. She added that discretionary grant applications are made more attractive by a number of factors, including the ability to provide dedicated matching funds.

She praised the fact that the Arizona State Legislature has begun allocating funds for ADOT and called it “a big deal” that the Legislature approved nearly $1B in ADOT appropriations in the most recent session.

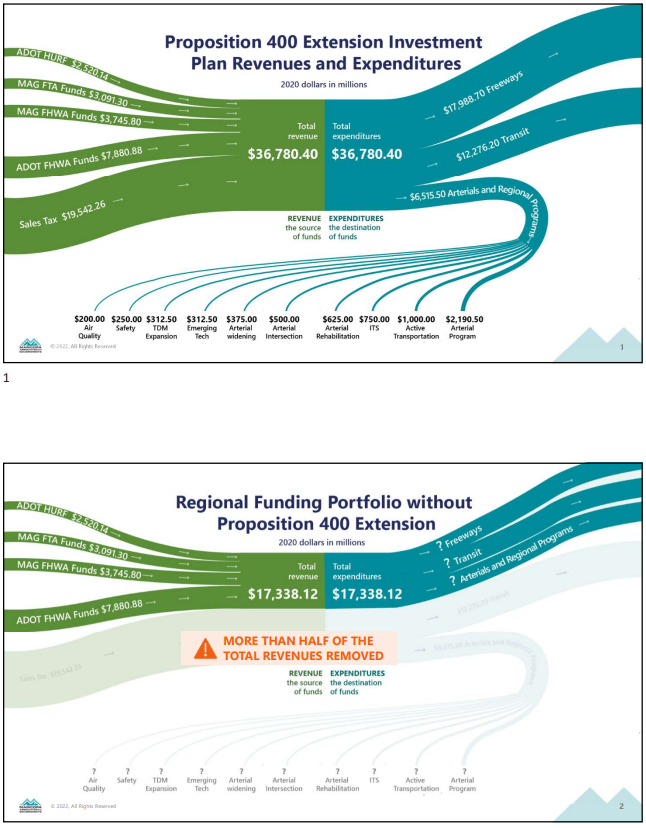

Koester Thomas then explained the current challenges facing MAG after Gov. Doug Ducey’s July veto of a bill that would have scheduled the current Proposition 400 half-cent sales tax for a March special election renewal vote. She pointed out that Prop 400 monies are a significant source of matching funds for transportation projects and that projects are now in jeopardy and facing significant delays because their sustained funding source is now uncertain.

(AZBEX NOTE: We recently covered the veto of the Proposition 400 extension, known as Prop 400E, in detail. To learn more, please go here, here, here or here.)

Ambrose gave attendees a historic overview of Gilbert’s use of transportation and infrastructure bonds and recapped the 2021 Streets, Transportation and Infrastructure Related Bond passed by Gilbert voters with a margin of just 162 votes. She explained that in putting the request together, officials structured it so that monies were available to categories of projects, rather than individual efforts, which allows for greater flexibility in allocating funds.

Later in the session Olds asked about the competitive nature of project funding. Koester Thomas explained that discretionary funding is competitive, and that the competition is fierce, with roughly eight times as many requests as there are awards available. She added that competitive awards require a local match, and the more matching money a request can guarantee, the more attractive the project becomes, with a 40% match being a general target. She then reiterated that the half-cent sales tax that has funded so much of the Valley’s transportation and economic development since its first approval in 1985 is the source for the area’s local matches.

When asked about the implications of the veto, she used the current state of the State Route 30 – Tres Rios freeway as one example. A portion of the project had been out for design bid by ADOT. After the veto, that solicitation was pulled because of questions over future funding. Estimates now are the project segment will be delayed by two years and cost $300M more than it would have if the process flow had not been interrupted.

Ward agreed and said the half-cent tax has been a key economic development driver for the Valley and the state and that there are tremendous impacts associated with possibly losing it as a revenue source.

Olds then segued into asking the panel about inflation and project cost increases.

Ambrose pointed out the Gilbert 2021 bond was worded around project categories rather than funding for specific projects. She expressed gratitude for the foresight in structuring the request that way, but concern that not all the items that need to be addressed will be handled as fully as they could have been without the current state of inflation.

Koester Thomas said MAG is seeing bids come in at 20%-30% more than estimates. She said, however, that one upside of relying on a sales tax versus a bond is that sales tax revenues also increase due to inflation.

Ward said the impact is that ADOT will have to do less because, “Dollars don’t change. The value of dollars does.” She said when the amount of money is fixed, there is no option but to do less.

Olds closed the session by asking the panel what industry can do to support planning and funding efforts.

Ward said it is important to battle misinformation and to define expectations. She asked attendees to look at what the Department is actually doing and to trust that it is working to get funding in place as far across the board as possible.

Ambrose urged vendors and service providers to help cities and agencies find ways to save. She urged them to “give us information and options.”

Upcoming Water Infrastructure Projects

The day’s final panel was an overview of Upcoming Water Infrastructure Projects. The panel was comprised of:

- Jaren Murphy – McCarthy Building Companies director of business development (Moderator),

- Marc Ahlstrom – City of Mesa assistant city engineer, and

- Troy Hayes – City of Phoenix water services director.

After the panelists introduced themselves and explained how their operations were funded, Murphy asked them to address the impacts of recent federal funding and stimulus availability. To the obvious surprise of some attendees, Hayes said that because of the degree of red tape and extensive requirements lists, Phoenix found it both easier and cheaper to bond for projects internally.

Murphy then asked how the labor shortage was impacting operations and project delivery. Ahlstrom said a key challenge has been finding and retaining engineers. He said job postings have gone from receiving 50-60 applications to receiving just five or six. He said there were similar problems finding plant operators and that recruitment and retention was a continuous problem across all positions.

Hayes said Phoenix has encountered similar issues, but he expressed optimism and appreciation for the various apprenticeship programs available to partner with for labor development.

In terms of how the industry can help cities with their current difficulties, both panelists urged partnership, involvement and information sharing. Ahlstrom said agencies rely on providers’ expertise and urged contractors and other vendors to deliver alternative ideas on items like design and materials. He also urged them to get involved in the process as early as possible.

Hayes reminded contractors that they are on the so-called “front lines” and urged their help in identifying unknowns and potential pitfalls agencies may not yet be aware of.

The BEX FY 2022-2023 CIP Special Report

As is part of the Public Works Conference every year, the event coincided with the release of the BEX FY 2022-2023 CIP Special Report. This year’s is the 12th annual edition and contains detailed descriptions and line-item breakdowns of major projects from agencies around the state.

Every March, BEX Research staff begins tracking preliminary CIPs from more than 25 agencies around Arizona and spends the next six months assembling project information, cost and timeline details, and contact lists for agencies and major projects.

This year’s CIP is available through the BEX website here.